The NEK Prosperity Fund is here!

A capital loan fund for small business owners in the NEK.

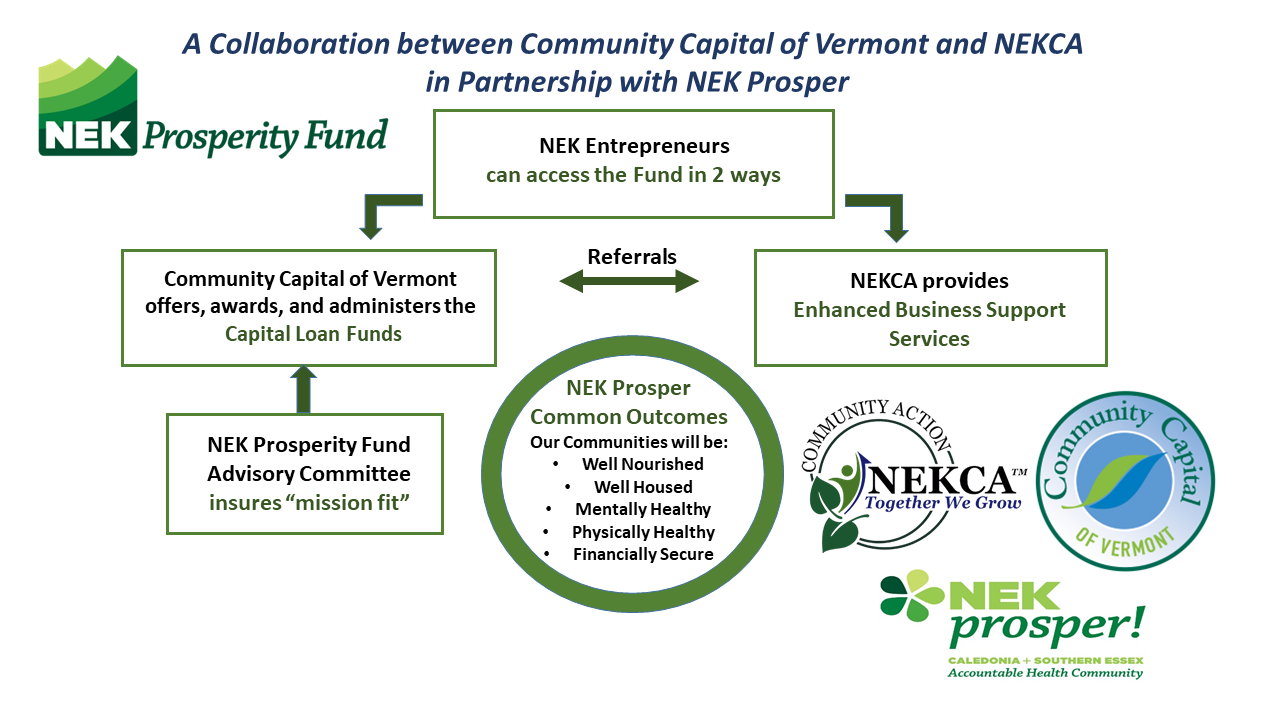

The NEK Prosperity Fund is a project of NEK Prosper, Northeast Kingdom Community Action (NEKCA), and Community Capital of Vermont. We created the NEK Prosperity Fund to organize and focus investment on equity and population health. The loan fund, administered by Community Capital of Vermont, will redistribute capital to qualified entrepreneurs and non-profit organizations to grow in the Northeast Kingdom. Loan recipients will receive enhanced business support services from financial and business counselors from NEKCA.

How to apply

A Community Capital of Vermont Business Resource Manager can assist you by phone or in person with any loan application. Call them at 802-479-0167 to discuss the application process or visit https://www.communitycapitalvt.org/borrowers/business-advisory-services/.

A NEKCA Business and Financial Counselor is able to assist you at every step of the loan application process. E-mail Dustin Smith at dsmith@nekcavt.org.

Investing for Good in the NEK

How we measure our impact on community health and well-being

NEK Prosper has a goal of improving the health and well-being of the people in Caledonia and southern Essex Counties by integrating efforts and services, with an emphasis on reducing poverty in our region. Specifically, NEK Prosper wants communities that are: Well-Nourished, Well-Housed, Mentally Healthy, Physically Healthy, Financially Secure.

The NEK Prosperity Fund includes a Social Return on Investment (SROI) component. The concept of SROI is that a thriving local business can make the NEK a better place for all to be healthy and live well. SROI is a way to intentionally measure and optimize an investment as to how it benefits society, not just the individual entrepreneur or business. NEK Prosperity Fund uses SROI measures and indicators as part of the process to evaluate the impact and success of the fund.

The Fund includes an Advisory Committee to ensure funds advance the mission of NEK Prosper and provide a SROI. An Advisory Committee member will work with each Prosperity Fund borrower to identify and track their unique social return on investment measures.

Who we fund and benefits to the borrower:

Qualified Borrowers:

Qualified borrowers must be a VT resident at or below 80% State Median Income looking to start and run a microbusiness in Orleans, Essex or Caledonia County.

Benefits to the Borrower:

Flexible Business Financing

As an Economic Development Lender loan terms are flexible. Community Capital of Vermont can structure loans creatively and may include interest only, seasonal payments, extended amortization periods, and other terms which reflect the borrower’s business cycle and other considerations.

Enhanced Business Support Services

Business and financial counselors at NEKCA offer NEK Prosperity Fund borrowers the following services at no cost:

- Business idea assessment, business plan and marketing plan development

- Financial capacity and management

- Budgeting

- Assistance with business loan applications

- Assistance with marketing materials

- Classes / Workshops / Seminars

- Organizational structure development